China’s central bank said the measures would reduce borrowing costs and inject more liquidity into the market.

China said it would take steps aimed at lowering borrowing costs, injecting more liquidity into the economy, and easing mortgage repayments for households amid signs that Beijing’s growth target for the year is slipping out of reach.

China’s central bank said Tuesday it would lower borrowing costs, inject more liquidity into the economy, and ease mortgage repayments.

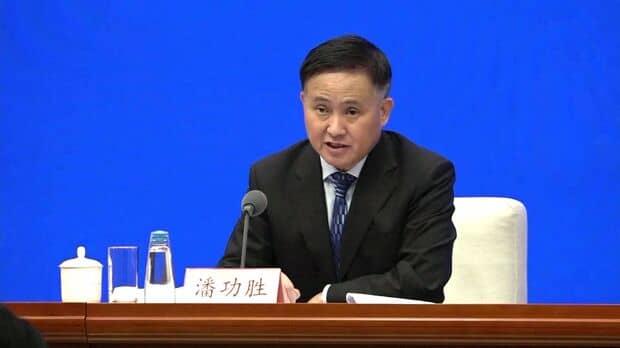

Pan Gongsheng, the Governor of the People’s Bank of China, noted that the central bank will reduce the amount of cash the commercial banks should hold as reserve-cum-dividend bearing, called the reserve requirement ratio (RRR) by 0.5 percentage points next week.

According to Pan, this move is expected to inject about 1 trillion yuan ($141.7bn) in “long-term liquidity” into the market. He said the rate could be cut further by 0.25-0.5 percentage points later this year based on liquidity conditions.

Pan said the seven-day reverse repurchase rate, one of many rates Beijing uses to control monetary policy, will be cut by 0.2 percentage points. Pan also intends to boost support for the underperforming property sector, including slashing interest rates for existing mortgages.

Chinese equities have had their best rally since February of last year when Pan announced.

“This is a step in the right direction,” Julian Evans-Pritchard, head of China economics at Capital Economics, wrote in a note. “But it will probably be insufficient to drive a turnaround in growth unless followed up with greater fiscal support.”

Beijings’ growth target of around 5pc for 2024 has been under a cloud amid a prolonged real estate slump, deflationary pressure, high youth unemployment, and ballooning debt levels among local authorities.