Benchmark equity indices declined in early trade on May 8, reflecting feeble trends from Asian markets and continuous foreign fund outflows.

Continuing its downward trajectory from the previous day, the BSE Sensex, comprising 30 shares, dropped by 363.09 points to 73,148.76. Similarly, the NSE Nifty declined 116.9 points, settling at 22,185.60.

Among the major laggards in the Sensex basket were Asian Paints, Larsen & Toubro, Hindustan Unilever, HDFC Bank, Nestle, and Mahindra & Mahindra. On the other hand, Tata Steel, Maruti, State Bank of India, and JSW Steel experienced gains.

Asian markets, including Seoul, Tokyo, Shanghai, and Hong Kong, also reported lower performances. Meanwhile, Wall Street ended on a mixed note on May 7.

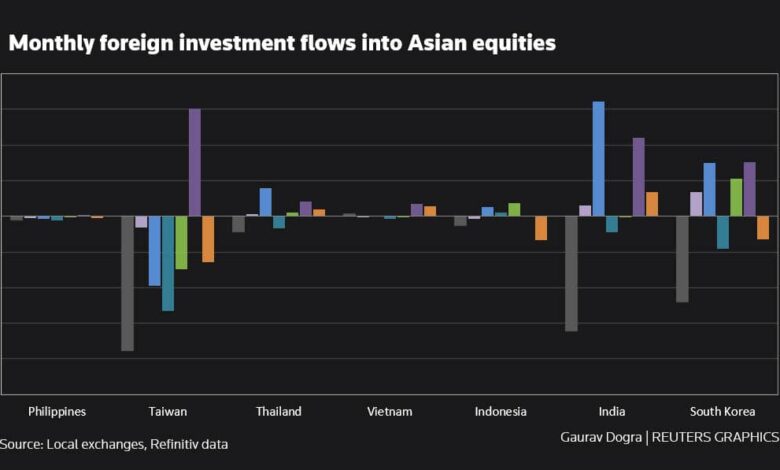

According to exchange data, Foreign Institutional Investors (FIIs) offloaded equities worth ₹3,668.84 crores on May 7. Additionally, the global oil benchmark Brent crude witnessed a 0.30% decline, settling at $82.91 per barrel.

After relinquishing its early gains, the BSE benchmark recorded a further decline of 383.69 points or 0.52%, ultimately settling at 73,511.85 on May 7. Similarly, the NSE Nifty declined 140.20 points or 0.62%, closing at 22,302.50.