I have a Rs 50 lakh home loan that is borrowed at a floating interest rate of 9 percent and have still 15 years out of a total 25 years to pay. At the moment, I am thinking of shifting to fixed-rate home financing. Switching to a fixed rate or sticking with the floating rate—which is preferable?

Atul Monga: The option of opting for a floater home loan and converting it to a fixed-rate home loan depends again on factors such as the existing trend in the interest rate, one’s stability in the monetary aspect, and also on the policies of the company.

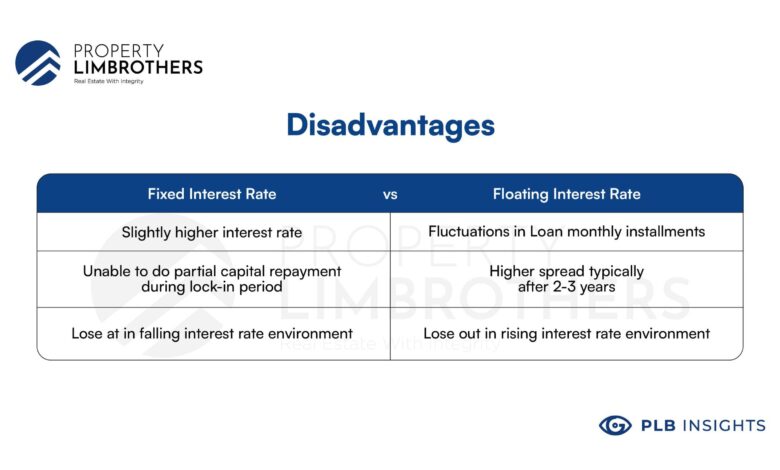

Interest Rate Trends: If you think that interest rates are going to increase in the future, then it will be advantageous to shift to fixed rates. But transitional rates are expected to decline or at most to be stable. On this account, it will be wiser to keep to a floating rate and thus avoid spending more than you have to.

Financial Stability: A fixed-interest rate reduces the budget risks because it creates a certain amount that has to be paid monthly.

Hence, if one wants to be assured of the rates of the monthly payments, a fixed rate will most of the time be the best option. At the same time, the floating rate would be quite preferable if the interest rates dropped.

To assist you in making a decision, it is possible to view certain scenarios in more detail below.

Floating Rate Scenario: For illustration, let us assume that you go on paying 9% as a floating rate for five years, and the rate brings down to 8%.