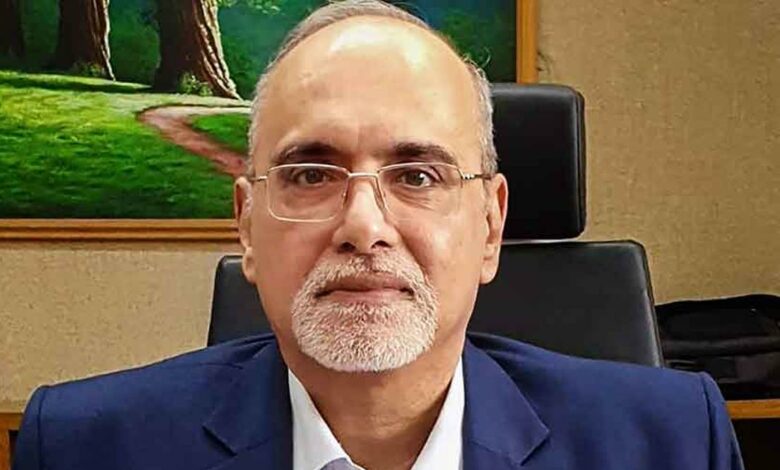

RBI Deputy Governor M Rajeshwar Rao avers the “temptation” of quick benefits can simply eclipse the long-term fiscal protection for individuals.

In the wake of concerns arising from a spurt in unsecured lending and a euphoria in derivatives, Reserve Bank Deputy Governor M Rajeshwar Rao on Friday urged financial sector players to be careful against “reckless financialisation . Addressing an event in stock exchange NSE here, Rao stated that the “temptation\” of short-term gains can easily dominate the long-term financial security for individuals.

“We need to be cautious about the risk of reckless financialisation,” he stated. Rao noted that concerns have been raised about over-borrowing in the unsecured segment and “derivative euphoria” in the capital market. Financial institutions must ensure that customers know fully well what the risks are in leveraged products and speculation,” he said.

Rao stated that RBI is cooperating with other regulators of the financial sector to enlighten customers, and further added that it is because of the lack of financial literacy that people become victims to unscrupulous players. But whenever any failure occurs, it is the faith of the investor in the financial system that gets damaged and therefore it becomes necessary for the system to invest in education for their betterment.

Days after Governor Sanjay Malhotra’s assurance on paying heed to the cost of regulation while setting rules, Rao said that financial regulation in a fast-paced world is a delicate balancing act. Too little regulation may increase systemic risk, while excessive regulation can stifle innovation, limit credit availability and raise costs,” Rao said.

He further stated that financial inclusion is “superficial” if accounts opened under the Jan Dhan Yojana are not accessed, and stated that the UPI has built a huge financial footprint for the informal sector that can be accessed by lenders to bring such people or entities into the mainstream.

The RBI’s unified lending interface has facilitated 6 lakh loans of Rs 27,000 crore as of December 6 last year, Rao said, adding that 36 lenders are active on the platform which pulls data from 50 sources. With artificial intelligence and machine learning being utilized extensively, Rao indicated that the origin of challenges for the financial system is explainability deficiency and this can potentially erode confidence in the system.