Nate Anderson, founder of Hindenburg Research, is now under scrutiny for securities fraud for sharing non-public information with hedge funds before releasing his firm’s reports,” lawyer Jai Anant Dehadrai said

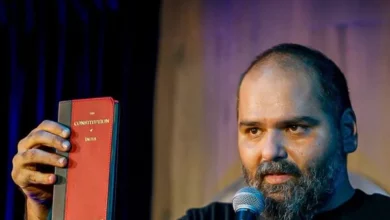

New Delhi: Lawyer Jai Anant Dehadrai attacked Hindenburg Research chief Nate Anderson after reports said the US short seller is under scrutiny for securities fraud.

The head of Canada’s Anson hedge fund, Moez Kassam, said in Court documents filed at the Ontario Superior Court of Justice in a defamation suit that his firm shared research “with a wide variety of sources,” including Nate Anderson. The Market Frauds portal claimed that court documents allegedly showed Hindenburg colluded with Anson while preparing a report.

While short sellers borrow security, sell it on the open market, and expect to repurchase it for less money after their damning report against the company brings stock down, involvement of hedge funds raises eyebrows as they could also place parallel bets, putting more downward pressure on stock prices.

Reacting to the development, Mr Dehadrai, a noted white-collar criminal law practitioner, said in a post on X, “Big News. Nate Anderson, founder of Hindenburg Research, is now under scrutiny for securities fraud for sharing non-public information with hedge funds before releasing his firm’s reports. Court documents from Canada suggest that Anderson conspired with Canada’s Anson Funds, providing them with early drafts of Hindenburg’s reports.”