Thrasio Holdings, one of the largest Amazon roll-up companies, has filed for bankruptcy protection after overextending itself during an aggressive acquisition spree of third-party Amazon sellers.

Thrasio had raised over $3.4 billion in funding to consolidate small and medium Amazon FBA businesses under its umbrella. However, the unraveling debt market has curtailed its ambitious growth plans.

The company said it will use bankruptcy to restructure its finances and continue operations. However, the dramatic reversal highlights risks in the investor-fueled Amazon aggregator model.

Thrasio was among the most active acquirers, having bought up over 200 seller businesses to become the largest consolidated player on Amazon. It had inked deals to acquire sellers with up to $50 million in annual revenue.

However, the breakneck buying pace required substantial debt financing. With interest rates surging, the excessive leverage proved unsustainable. The company could not raise enough to fund its $1 billion in potential seller acquisitions.

Thrasio said the restructuring will allow it to right-size its capital structure and continue acquiring Amazon sellers. However, investors are likely to be wary of funding such roll-ups shortly.

The company was considered a pioneer of the Amazon roll-up sector. It popularized the model of buying out small third-party merchants and consolidating them to drive growth and efficiencies.

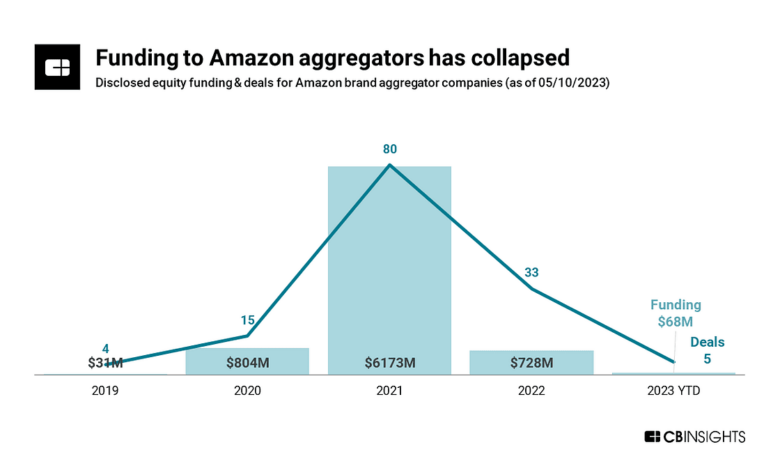

Rival aggregators like Perch, Heyday, Heroes, and Acquco have also raised billions to replicate the strategy. But they may need to temper expectations, given Thrasio’s humbling bankruptcy.

The key premise of scaling up rapidly by acquiring hundreds of Amazon sellers appears flawed. Integration challenges, changing Amazon algorithms, and mounting debt make it prone to implode.

Thrasio’s bankruptcy filing is a cautionary tale. The land grab model to instantly become the biggest player is risky if fundamentals like cash flows and synergies do not support such hyper-growth.

Other roll-ups may take a targeted approach, acquiring sellers strategically rather than indiscriminately without diligence. The aggregator space now faces trust and credibility issues after Thrasio’s dramatic fall. They may struggle to attract sellers or raise future capital.

Ultimately, the saga underscores that there are no shortcuts to building a sustainable Amazon roll-up at scale. Growth needs to be underpinned by strong operations, integration, and cash flows rather than just a spending frenzy fueled by easy money.