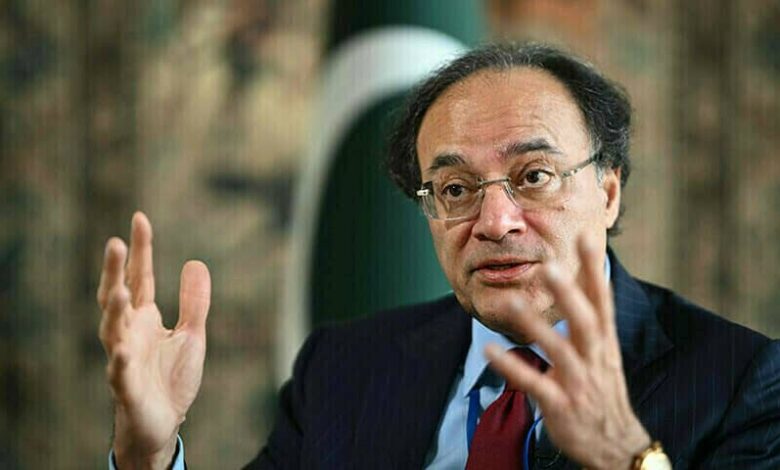

Pakistani Finance Minister Muhammad Aurangzeb said his country has formally applied to be considered for a share of the IMF’s Resilience and Sustainability Trust funding facility and is in touch with AIIB and West Asian banks for financial aid.

Pakistan has formally approached the International Monetary Fund’s new facility to aid low—and middle-income countries in facing climate risks, Finance Minister Muhammad Aurangzeb said on Thursday (October 24).

“We have formally requested to be considered for this facility,” he told Reuters at the IMF/World Bank autumn meetings in Washington. He added that Pakistan is expecting to finalize the request in subsequent months.

Pakistan has already received the $7 billion bailout package approved by the IMF; however, some funds that are accessible are those available within the Resilience and Sustainability Trust.

The RST is an institution that deals with long-term concessional financing. Established in 2022, it is designed to finance climate-related projects, including adaptation measures and the transition toward clean energy.

According to the Global Climate Risk Index, Pakistan is one of the countries most vulnerable to climate change.

Aurangzeb said that in addition to the ones it’s negotiating with the IMF, Pakistan is currently holding talks with the Asian Infrastructure Investment Bank (AIIB) for credit enhancement on its planned Panda bond.

A Panda bond would be Pakistan’s maiden foray into China’s capital markets.

The first bond issuance pegged at $200-250 million, is expected by the end of June.

Pakistan is also negotiating with West Asian banks for commercial loans, and one bank agreed to make a “significant proposal,” said Aurangzeb.

Aurangzeb said the country is also negotiating with other institutions for credit enhancements.

“These enhancements provide guarantees on the bonds and can help enhance the rating of these instruments, improve investor appetite, and decrease borrowing costs,” he said.

He said Pakistan’s foreign exchange reserves should touch $13 billion by the end of the month, which would strengthen its efforts to garner commercial loans and, thus, improve its credit rating.

Pakistan’s central bank said its foreign exchange reserves stood at $11.04 billion as of October 18.